Chauncey grew up on the farm in rural northern California. At 18 he ran absent and saw the earth having a backpack and also a charge card, getting which the accurate price of any stage or mile will be the practical experience it facilitates.

Most dependable associate that may help you form and mature your small business: Determined by a January 2023 study of small- and midsize-entrepreneurs evaluating LegalZoom to other on line authorized providers businesses.

The commonest type of LLC is a domestic, single-member LLC. This sort of LLC is owned and operated by 1 human being and is also the most typical corporate framework for freelancers, consultants and unbiased contractors.

Watch all investmentsStocksFundsBondsReal estate and substitute investmentsCryptocurrencyEmployee equityBrokerage accounts529 higher education discounts plansInvestment account reviewsCompare on line brokerages

Productive August one, 2013, the Delaware Limited Liability Company Act delivers that the administrators and controlling customers of the Delaware-domiciled limited liability company owe fiduciary responsibilities of care and loyalty towards the limited liability company and its members.

Consider your market, the amount of customers, and the desired volume of liability defense when choosing the appropriate LLC structure for your business. Careful planning and analysis of your business aims will information you towards the most suitable structure for your personal venture.

A limited liability company (LLC) is a company structure combining the tax benefits of a partnership Along with the liability protections of a corporation.

An LLC member can act as a registered agent for that LLC provided that they have an address within the point out that the LLC is registered in.

You're self-utilized if your LLC is classified as being a sole proprietorship or partnership. You will report business enterprise cash flow and expenditures go here on your personal tax return (partnerships also file a partnership return). more info You can spend profits and self-employment (Medicare and Social Safety) taxes with your share of company earnings.

This outlines your LLC's policies for almost everything from enterprise construction to income distribution. Our templates enable it to be simple for LLC entrepreneurs to define their rights and Restrict disagreements.

The law firm or regulation firm you happen to be speaking to isn't required to, and could pick out to not, acknowledge you for a client. The world wide web isn't always protected and e-mails sent as a result of This web site can be intercepted or browse by third functions. Thank you.

As the first perception within your LLC, choosing the ideal name is paramount. A singular, unforgettable, and correct name can established your organization up for success. But it's not nearly branding—your LLC title need to also fulfill certain condition necessities, which can change depending upon the style of LLC operator.

Greatest IRA accountsBest on the net brokers for tradingBest on the net brokers for beginnersBest robo-advisorsBest choices buying and selling brokers and platformsBest investing platforms for working day buying and selling

However, LLCs also have the option to elect S Company or C Company taxation, which can provide added tax benefits and suppleness. S firms are exempt from federal money taxes, with shareholders subject to person taxation.

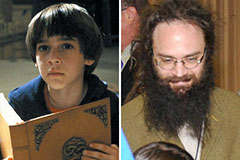

Barret Oliver Then & Now!

Barret Oliver Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!